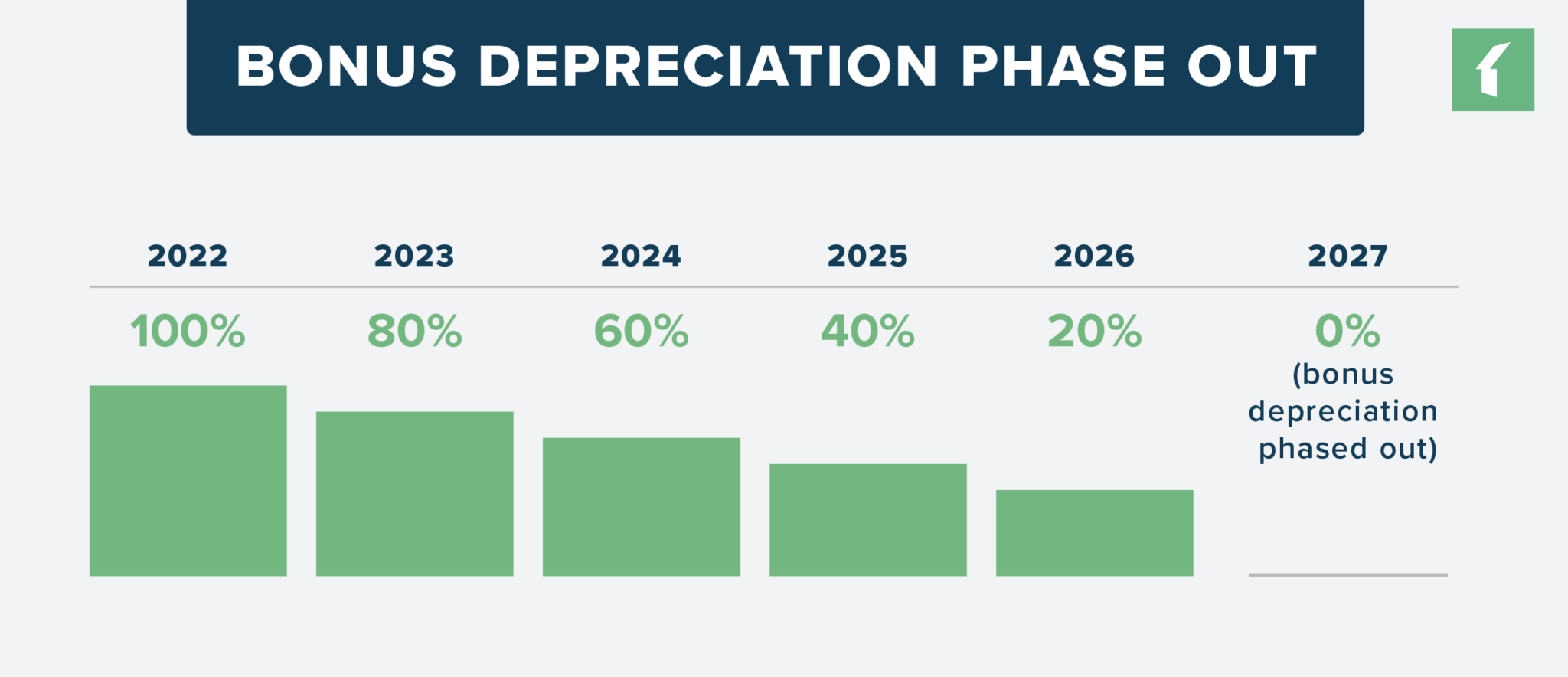

Bonus Depreciation 2025 Limitations. How is bonus depreciation set to change in 2025? Beginning in 2025, the amount of bonus depreciation decreases by 20% each year until it phases out totally beginning in 2027.

The bill delays the beginning of the phaseout of 100% bonus depreciation from 2025 to 2026. 179 deduction rules are generous,.

2025 Bonus Depreciation Limitation Eleni Hedwiga, The 100% bonus depreciation phased out after 2025, with qualifying property getting only a 60% bonus deduction in 2025 and less in later years.

Bonus Depreciation 2025 Percentage Change Ted Shantee, One of the most significant provisions of the tax cuts and jobs act.

Bonus Depreciation 2025 Equipment Tana Zorine, Beginning in 2025, the amount of bonus depreciation decreases by 20% each year until it phases out totally beginning in 2027.

2025 Bonus Depreciation For Vehicles Caryn Cthrine, Bonus depreciation deduction for 2025 and 2025.

Bonus Depreciation Rate For 2025 Aleda Aundrea, The special depreciation allowance is 80% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2025, and before january 1, 2025 (other.

2025 Bonus Depreciation Rates Dannie Kristin, This means businesses will be able to write off 60% of the cost of.

Don’t miss out on bonus depreciation before it's too late Sol Schwartz, Extension of 100% bonus depreciation.

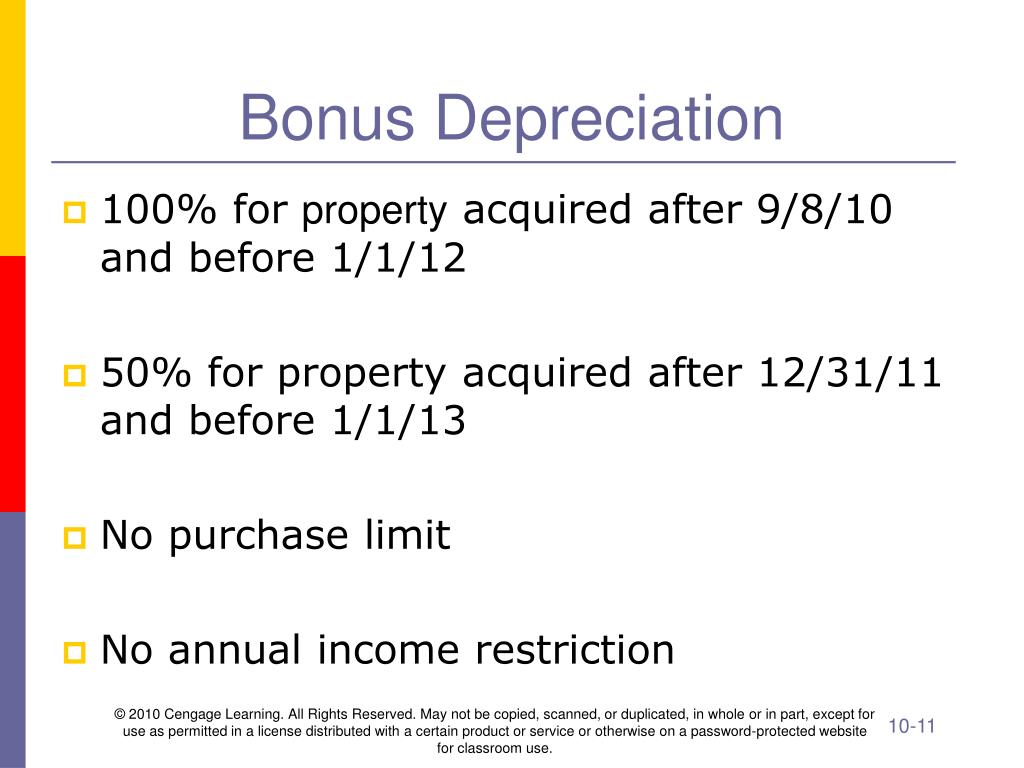

Limitations to the Bonus Depreciation Calculator Level of … Flickr, The rules and limits for bonus depreciation have changed over the years.

Federal Bonus Depreciation 2025 Tana Franciska, Bonus depreciation will continue to ramp down for ensuing years:

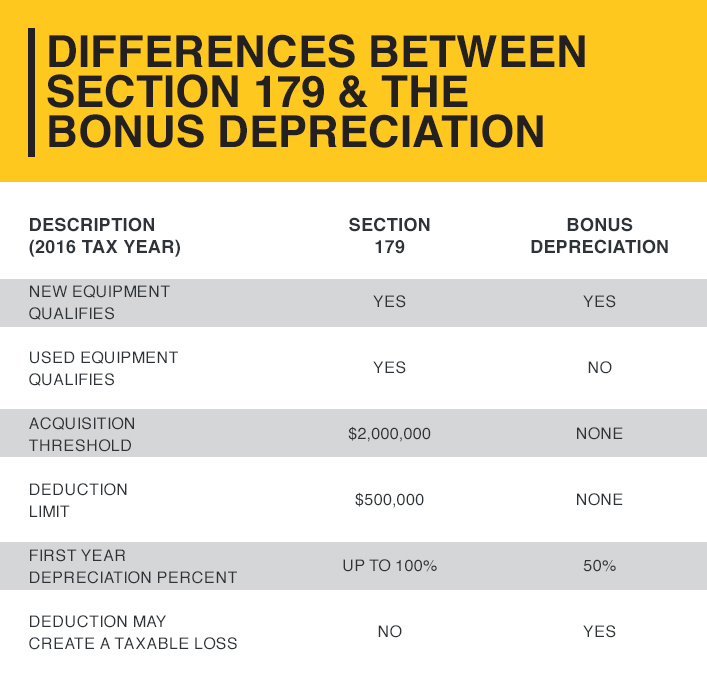

Bonus Depreciation 2025 15 Year Property Astrid Eulalie, Section 179 allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year, up to a certain limit.